8 501 C 3 Donation Receipt Template

Best practices for creating a 501c3 tax compliant donation receipt. Customizable with your groups name and ein.

Four Steps To Making Your Charitable Donation Eligible For A

Four Steps To Making Your Charitable Donation Eligible For A

Whatever the form every receipt must include six items to meet the standards set forth by the.

501 c 3 donation receipt template. Everything you need to know about donation receipts. Georgia nonprofit tax returnnon profit organization tax preparationnonprofit property tax exemption texasnonprofit sales tax exemption washingtonnonprofit tax billnonprofit tax deadline 2018nonprofit tax donationsnonprofit tax. Free 501 c 3 donation receipt template sample pdf.

In the usa only 501c3 registered charity can be considered as tax exempt such as private foundations and public charities. The donation receipt templates are fully customizable. It would be wiser though to give out donation receipts and acknowledge the donations a lot sooner so that donors or benefactors would be encouraged to make contributions again in the future.

Donation receipts are quite simply the act for providing a donor with a receipt for their monetary contribution to an organization such as a charity or foundation. A lot of non profit organizations give out their donation receipts at the end of the year when the donation has been given or in the first month of the next year. Donations grants fundraising nonprofit501c3 organization finance created.

The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc. 501c3 donation receipt templates. An outline of donation receipts and the tax deduction.

Facebook twitter pinterest linkedin email. Monthly donor automated tax receipts jane sterks suggestion. A donation receipt acts as a written record that a donor is given proving that a gift has been made to a legal organization.

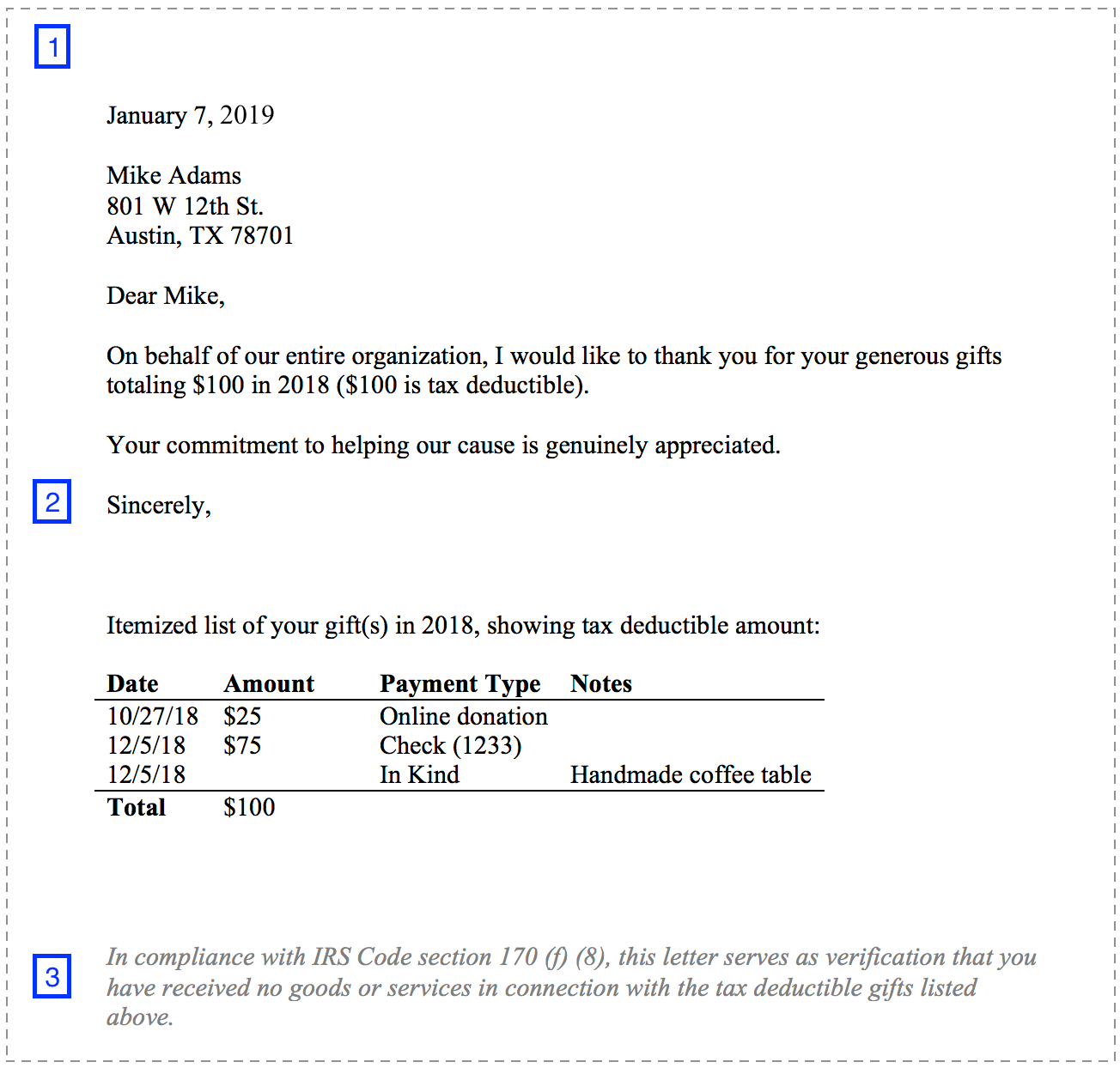

This picture nonprofit tax id form elegant non profit donation receipt form template useful 501 c 3 donation previously mentioned can be classed along with. When you design your own receipt based on our templates you should include the following information in the receipt. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction.

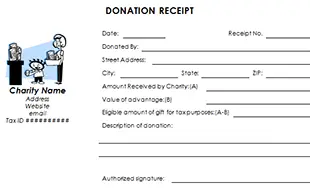

Form for community members who make donations to your group if its registered as a tax exempt charity. Information about the organization including logo name address tax identification number and a statement showing that the organization is a registered 501c3 organization. How to create a 501 c 3 tax compliant donation receipt.

The 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible.

These receipts are also used for tax purposes by the organization. Download the updated and fully editable nonprofit donation receipt form in excel format instead.

Free 501 C 3 Donation Receipt Template Sample Pdf

Free 501 C 3 Donation Receipt Template Sample Pdf

Create A Flawless Online Donation Receipt With This 11 Point

Create A Flawless Online Donation Receipt With This 11 Point

Free Customizable Donation Receipt Template Templateral

Free Customizable Donation Receipt Template Templateral

12 Free Sample Donation Contribution Receipt Templates

50 Free Donation Receipt Templates Word Pdf

50 Free Donation Receipt Templates Word Pdf

What To Absolutely Include In Your Year End Tax Letter

What To Absolutely Include In Your Year End Tax Letter

Belum ada Komentar untuk "8 501 C 3 Donation Receipt Template"

Posting Komentar