8 Mileage Log For Taxes Template

31 printable mileage log templates free the irs has strict rules about the types of driving that can be deducted from your taxes. Availing of a professional template for this particular irs mileage log is not difficult since there arent very many conditions or factors that you need to keep a track of.

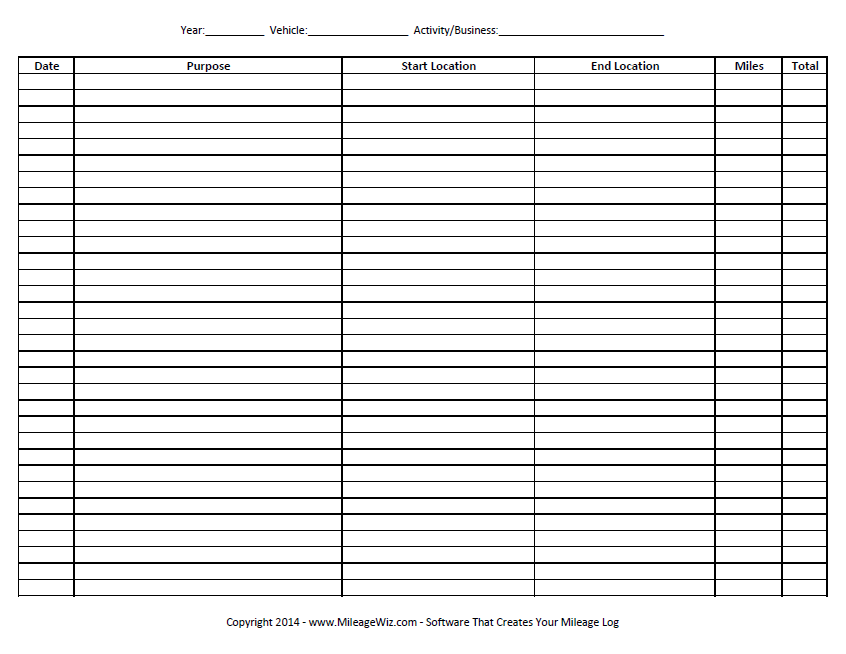

26 Printable Mileage Log Examples In Pdf Excel Ms Word

26 Printable Mileage Log Examples In Pdf Excel Ms Word

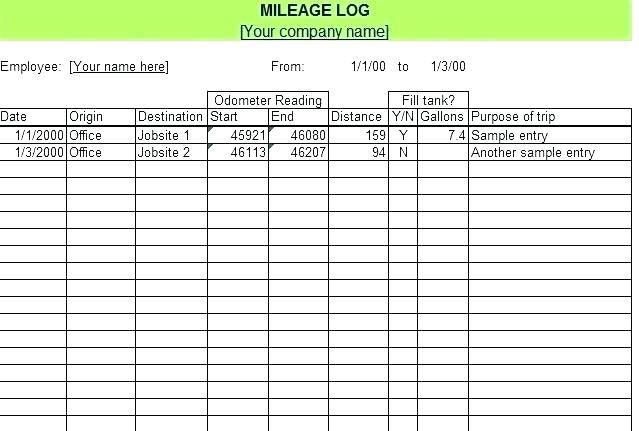

Download our free mileage log template what your mileage log needs to include.

Mileage log for taxes template. Another free printable mileage log template was created for drivers who need to organize their important records within a single form. The mileiq mileage log automatically calculates the deduction of your business drives. This template will calculate the value of your business trips based on this figure.

For a mileage log sheet to be valid for irs use it must contain some details. This printable template can be used for tracking your business mileage and other business related travel expenses for tax or reimbursement purposes. Free mileage log template for taxes.

A simple minimalist template will suit the purpose. Whether you work for some company or you are self employed this log will help you make sure you dont pay the taxes that you dont owe. Our free mileage log templates will help you track all the required information hassle free.

You can use the following log as documentation for your mileage deduction. Download pdf 541 kb download jpg 647 kb. This template is accessible.

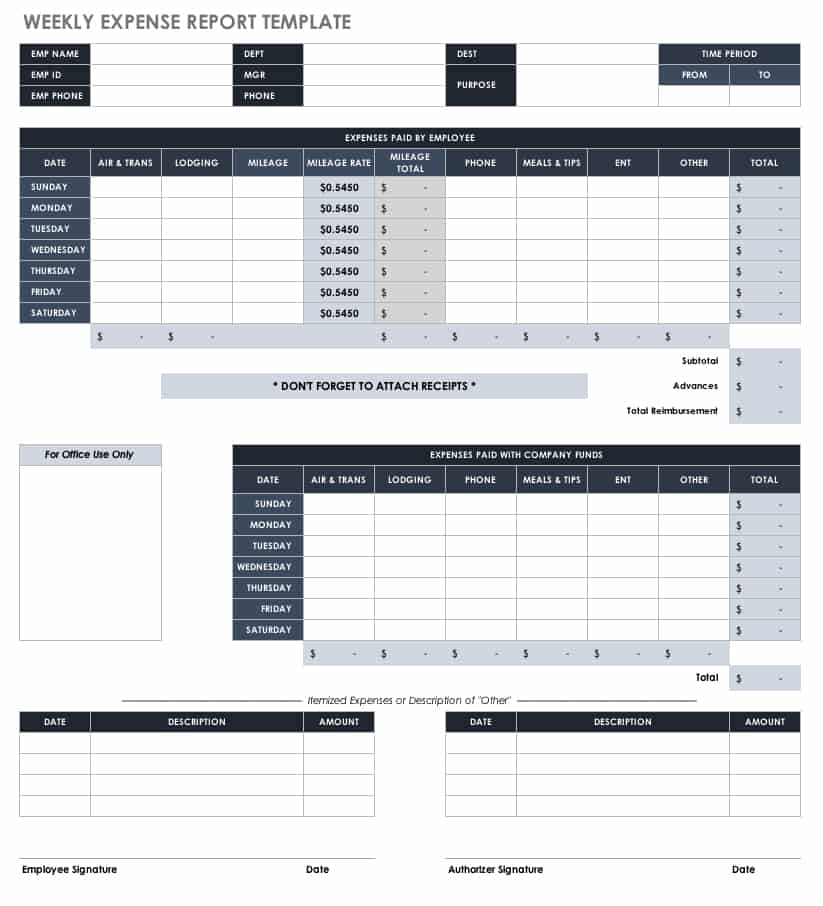

The irs as you would expect will not just rely upon your word and will need some evidence of the business mileage. Includes entries for date time drive classification business personal or commuting total miles for each drive and more. Using the standard mileage rate of 545 cents per business mile driven this template will calculate your deduction per trip making it easy to calculate your total deduction when it comes time to file your taxes on your schedule c tax form.

Mandatory information in a mileage log sheet. Track your mileage for taxes or reimbursement in this mileiq mileage log. There are many advantages for keeping a mileage log but the most important benefit is that with keeping this log updated you can claim tax deductions.

For 2020 the irs lets you deduct 575 cents per business mile. Keeping mileage log for tax purposes. Every mileage log form is different depending on the terms and conditions of the rate of deduction that is operation.

Many business owners are able to deduct the costs associated with their vehicle expenses for repairs and the miles its driven.

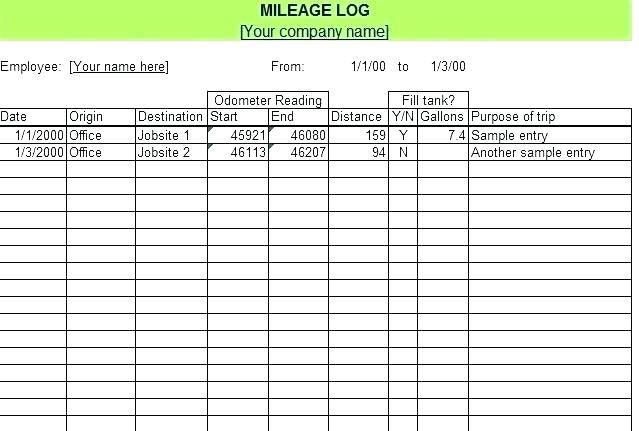

What You Need On Your Mileage Log

What You Need On Your Mileage Log

Mileage Log Form For Taxes Elegant Template Mileage Sheet

Mileage Log Form For Taxes Elegant Template Mileage Sheet

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

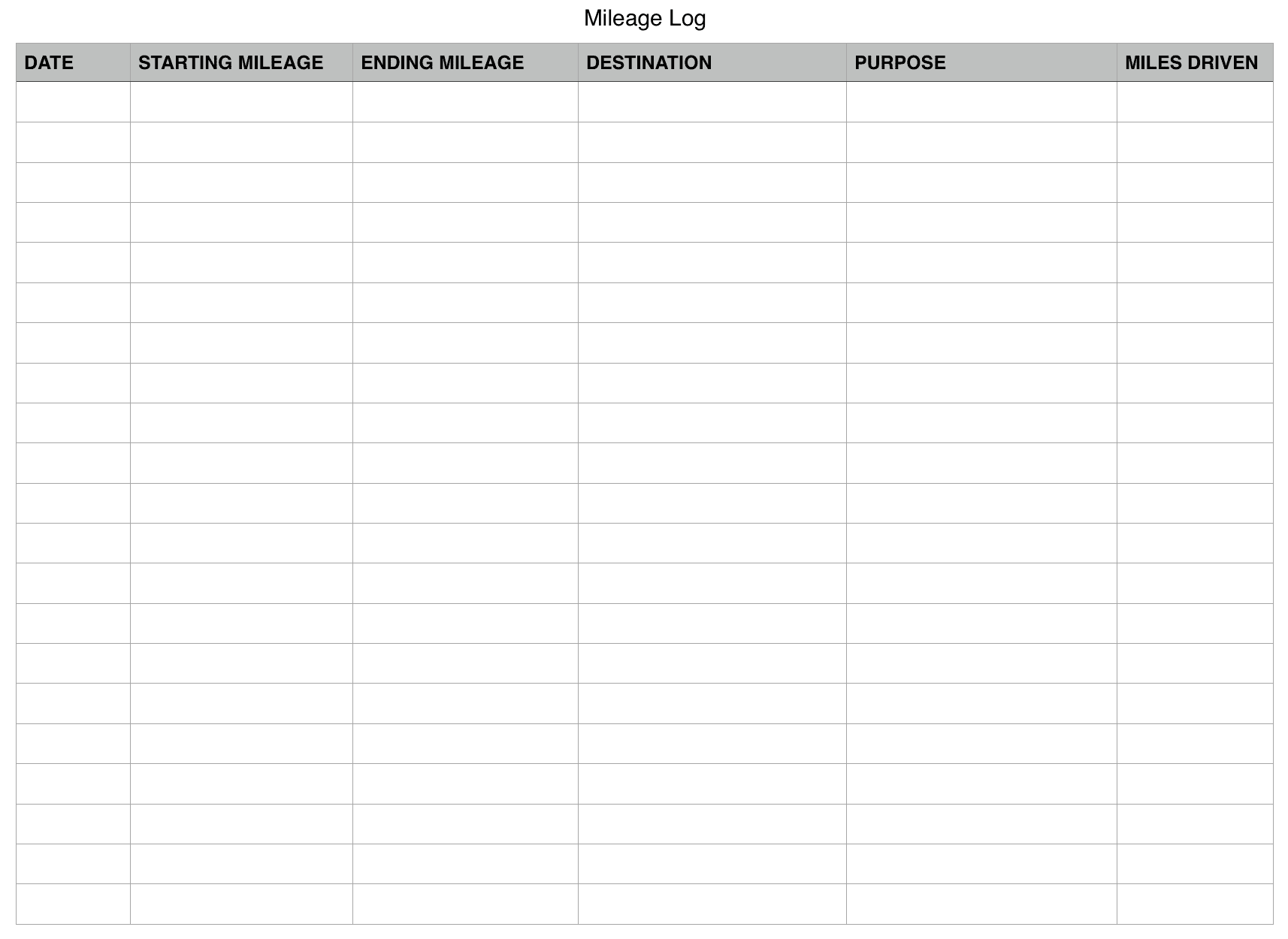

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Printable Mileage Log Templates For Excel Word Amp Excel

Printable Mileage Log Templates For Excel Word Amp Excel

26 Printable Mileage Log Examples In Pdf Excel Ms Word

26 Printable Mileage Log Examples In Pdf Excel Ms Word

Belum ada Komentar untuk "8 Mileage Log For Taxes Template"

Posting Komentar