8 Irs Mileage Log Template

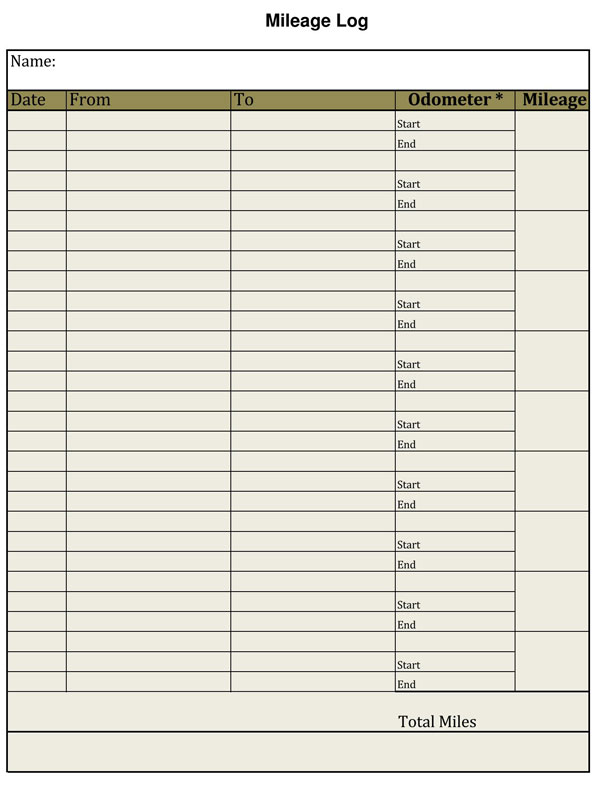

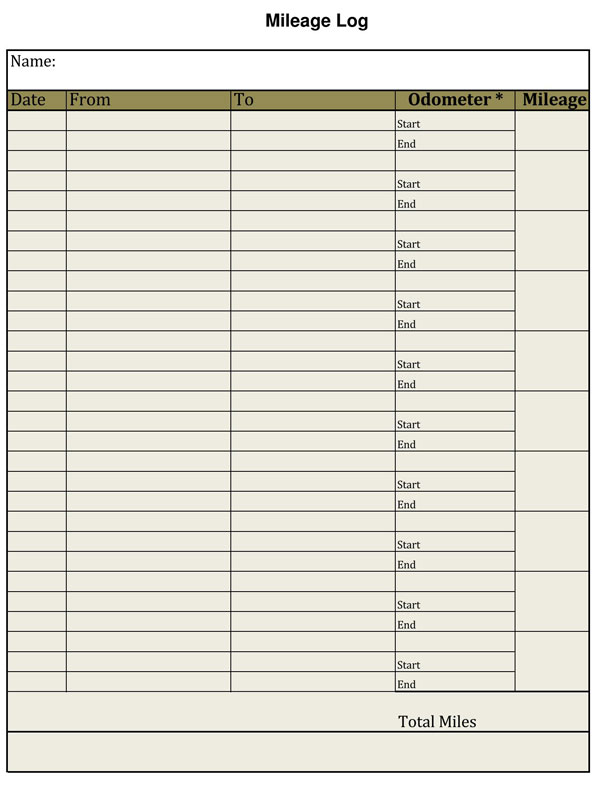

Yes everything you need to make a mileage log the slow and painful way. Many people record the time weekly or monthly which will not satisfy the irs if theres an audit of your recordsthe easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take.

Printable Mileage Log Templates 12 Best Documents Free

Printable Mileage Log Templates 12 Best Documents Free

For 2020 the irs lets you deduct 575 cents per business mile.

Irs mileage log template. To claim deductions on your tax returns you have to keep meticulous records of your driving. Report your mileage used for business with this accessible log and reimbursement form template. Irs mileage log form.

Mandatory information in a mileage log sheet. A mileage log is important to maintain due to the following reasons. Mileage log and expense report.

Print it out put it in your vehicles glove box or keep it in your wallet so that you minimize the chances to forget logging every deductible mile on a regular basis. Our free downloadable excel mileage log will help you track your mileage manually and contains all the information youll need to meet irs standards. This printable irs mileage log form is created to make a drivers job of recording business miles hassle free.

Click to see full template version 15248 downloads 34 kb file size july 10 2009 updated 2 number of comments rating download this template for free get support for this template table of content this is a common mileage log used by many companies to track their vehicle trip or car operational expenses. What is a mileage log. For a mileage log sheet to be valid for irs use it must contain some details.

Are you looking for a straightforward irs compliant excel mileage log template. These free excel mileage logs contain everything you need for a compliant irs mileage log. A mileage log or a vehicle mileage log is a record of the miles of the vehicles that have been used for transportation.

Mileage and reimbursement amounts are calculated for you to submit as an expense report. You can use the following log as documentation for your mileage deduction. This template will calculate the value of your business trips based on this figure.

That also means receiving a total reimbursement. Ask a tutorfor free. Download pdf 541 kb download jpg 647 kb.

Using a mileage log is the best way to ensure that your manually tracked mileage is consistent and your records contain all the information required by the irs. The irs as you would expect will not just rely upon your word and will need some evidence of the business mileage. Date destination business purpose odometer start odometer stop miles this trip expense type expense amount.

It can help in fulfilling the irs requirements and timely and accurate records can be maintained and presented. And as long as the offered cent per mile rate falls at or below the irs safe harbor rate that reimbursement will be tax free. With a cent per mile cpm program a mileage log template makes it easier for mobile workers to check all the boxes for submitting accurate irs compliant mileage.

Stuck on math homework. When tax time rolls around you can use this mileage template to determine your deduction on your schedule c tax form. Our free mileage log templates will help you track all the required information hassle free.

So you want to make a mileage log the old fashion way.

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Free Business Mileage Log Template Vincegray2014

Free Business Mileage Log Template Vincegray2014

Mileiq Vs A Paper Mileage Log What S Better For Taxes Mileiq

Mileiq Vs A Paper Mileage Log What S Better For Taxes Mileiq

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

8 Free Mileage Log Templates To Keep Your Mileage On Track

8 Free Mileage Log Templates To Keep Your Mileage On Track

Belum ada Komentar untuk "8 Irs Mileage Log Template"

Posting Komentar