8 Donation Receipt Template For 501c3

It would be wiser though to give out donation receipts and acknowledge the donations a lot sooner so that donors or benefactors would be encouraged to make contributions again in the future. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction.

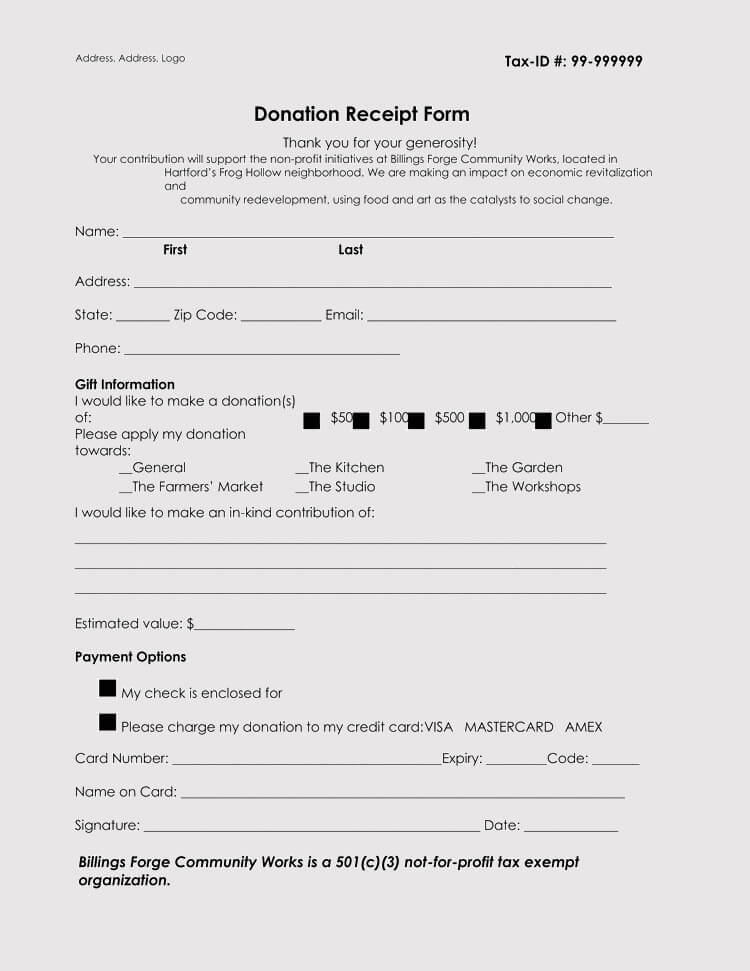

Tax Deductible Donation Receipt

Tax Deductible Donation Receipt

When accepting donations there are various requirements that your organization needs to meet in order to be compliant with the rules of your area.

Donation receipt template for 501c3. With a template you can customize the perfect receipt for your organization. A great way to achieve this is by downloading a template. If you are non profit and do not keep proper records you can be fined 1000 per donation and 5000 per charity event.

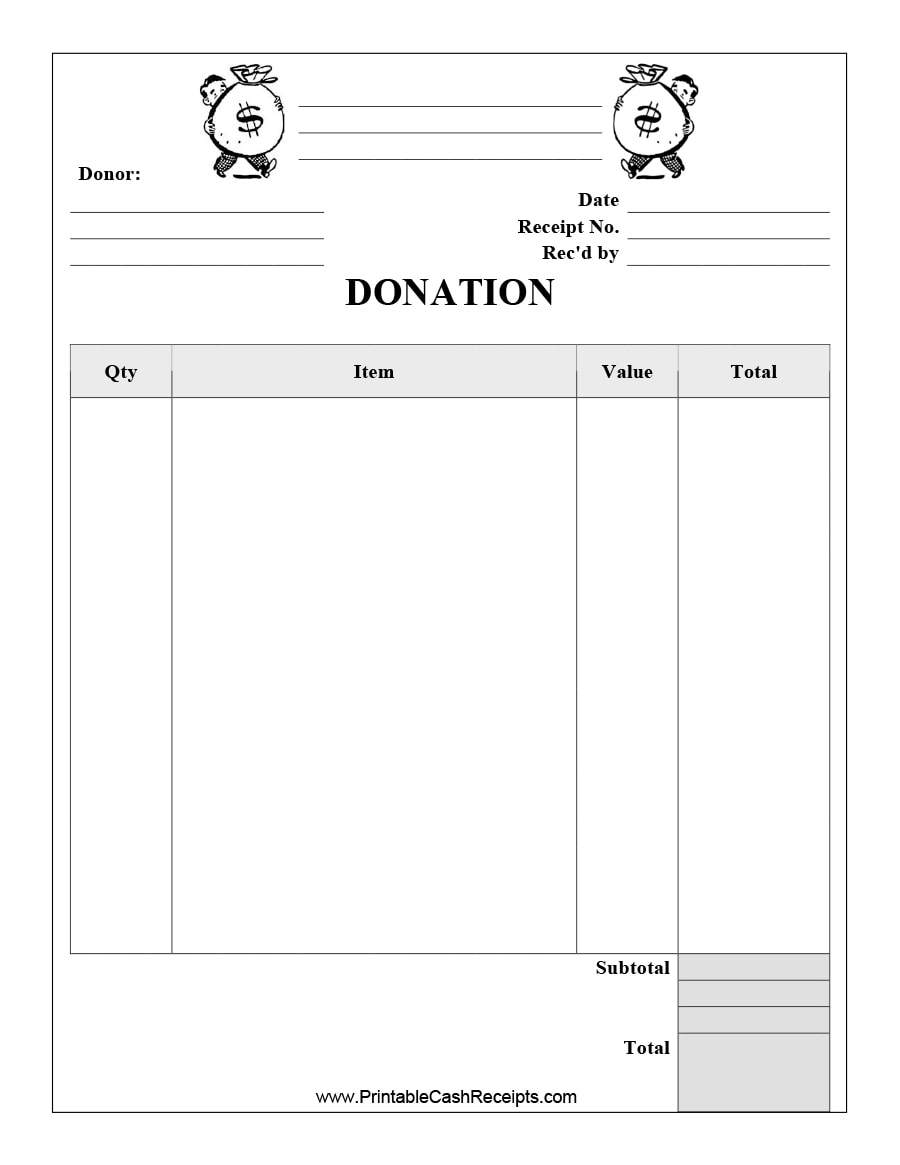

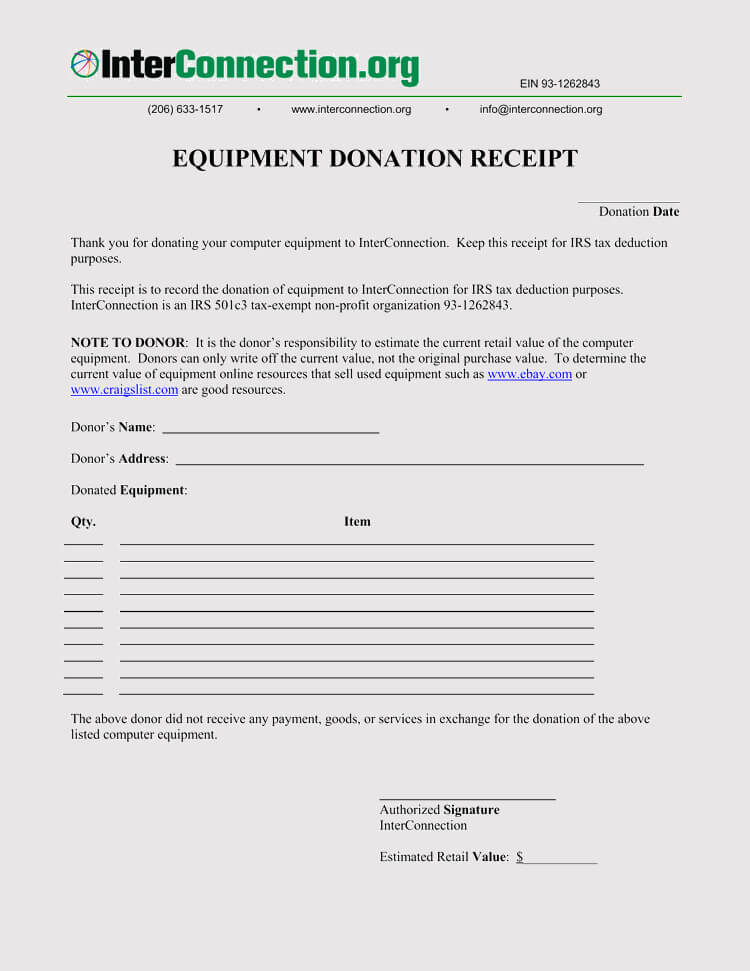

Donation receipts are necessary when it comes to both the giver and receivers accounting and record keeping. The 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. A donation receipt acts as a written record that a donor is given proving that a.

Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. Also make sure that your template for the non profit donation receipt is both professional and versatile. The 501c3 donation receipt template notification for taxes purposes also called form 501c3 is a doc to be provided to a factor of a nonprofit charity that may be recognized by the download this kind of receipt designed for charitable via shawls by hoda.

The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc. If you donate but do not obtain and keep a receipt you cannot claim the donation. Whatever the form every receipt must include six items to meet the standards set forth by the.

A lot of non profit organizations give out their donation receipts at the end of the year when the donation has been given or in the first month of the next year. One requirement is that you give donors a donation receipt also known as a 501c3. There are many things you can do to make sure your receipt includes everything and still looks impressive.

Best practices for creating a 501c3 tax compliant donation receipt. A non profit donation invoice provides records to those who have donate on your organization and serves as a list are you looking for info.

45 Free Donation Receipt Templates Non Profit Word Pdf

45 Free Donation Receipt Templates Non Profit Word Pdf

Non Profit Donation Receipt Template Using The Donation

Non Profit Donation Receipt Template Using The Donation

Free 10 Donation Receipt Examples Amp Samples In Google Docs

Free 10 Donation Receipt Examples Amp Samples In Google Docs

Custom Product Non Profit Charitable Donation 3 To A Page

Custom Product Non Profit Charitable Donation 3 To A Page

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

45 Free Donation Receipt Templates Non Profit Word Pdf

45 Free Donation Receipt Templates Non Profit Word Pdf

Belum ada Komentar untuk "8 Donation Receipt Template For 501c3"

Posting Komentar