10 1099 Contractor Agreement Template

This agreement made and entered into by and between mach4marketing having an address of 27306 dayton ln temecula ca 92591 hereinafter. 1099 contractor agreement agreement made as of between eastmark consulting inc a.

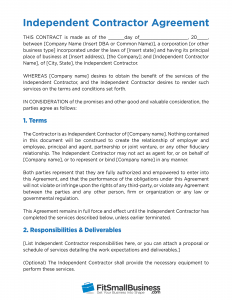

Free Independent Contractor Agreement Template Amp What To Avoid

Free Independent Contractor Agreement Template Amp What To Avoid

Contractor agreement which are incorporated herein by reference.

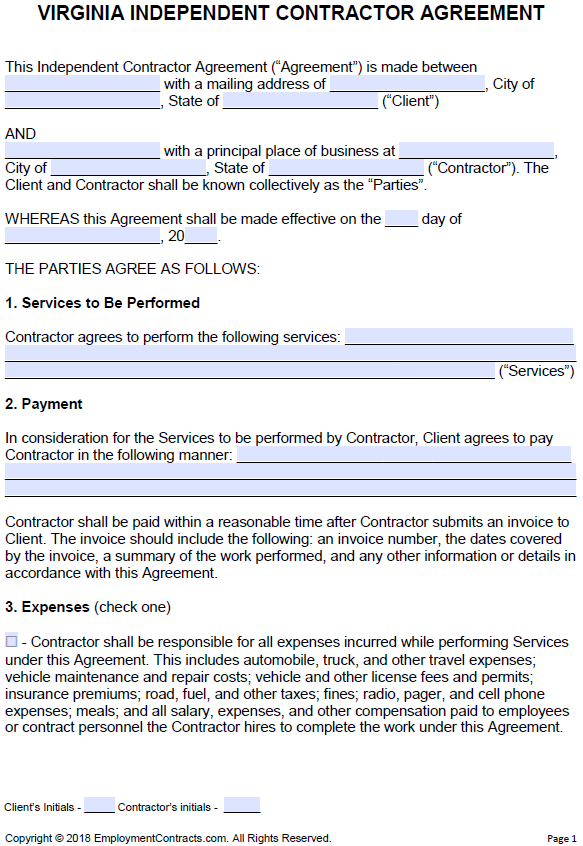

1099 contractor agreement template. In this document the parties are generally forming a relationship so that the contractor can perform one specific task. Unlike employees independent contractors are not bound to maintain secrecy under most state laws. Both parties are governed with all terms and conditions such as term and termination of services contractor services ownership and liability confidential information and other miscellaneous provisions.

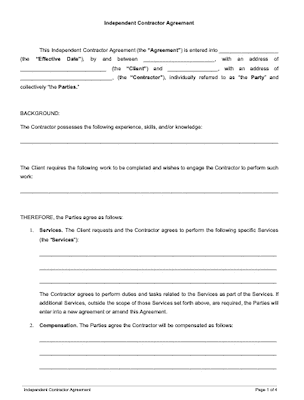

An independent contractor agreement is an agreement between two parties the independent contractor often called just the contractor and the recipient of services often called just the recipient. An independent contractor agreement also known as a 1099 agreement is a contract between a client willing to pay for the performance of services by a contractorin accordance with the internal revenue service irs an independent contractor is not an employee and therefore the client will not be responsible for tax withholdings. Professional services agreement for 1099 representative start date.

That is if you disclose a trade secret to a contractor without a nondisclosure agreement in. You are wise to get this agreement signed with independent contractors to protect your interests in any irs audit. This sample agreement template is signed between a sample contractor and a company hence it should also include some provisions to cover any local law if applicable.

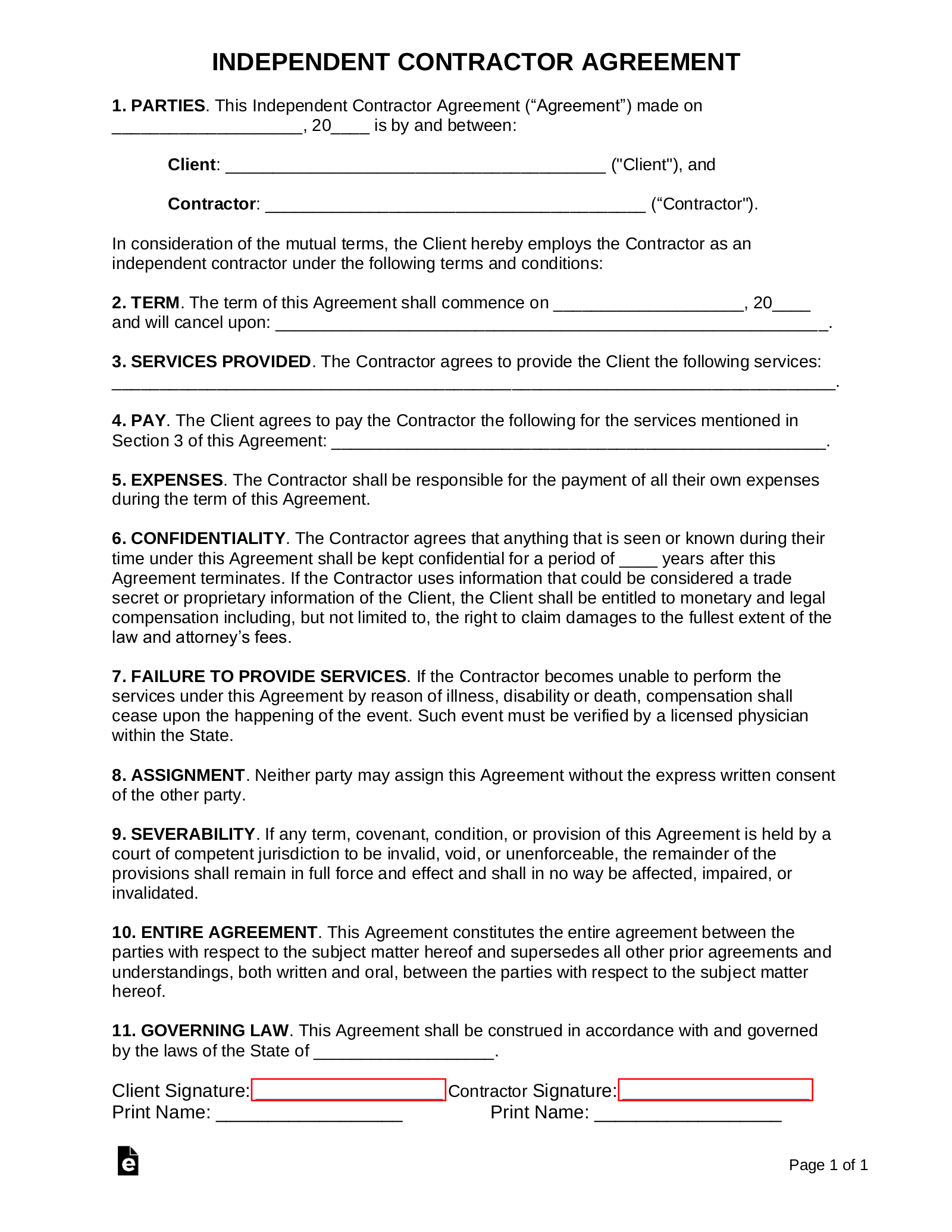

Upon agreement by both parties the work schedule location and payment cycle are written in the employment contract. In using an independent contractor agreement template you ensure that everyone at your startup who is part of the recruitment process uses a consistent and legally defensible document. When hiring independent contractors keep in mind there are special considerations that cannot be omitted from the contractor agreement such as any payments that are in lieu of hiring a permanent employee.

Description of services and project milestones the services to be performed by contractor are as follows. The employment status depends on the irs tax classification of the hired individual. This review list is provided to inform you about this document in question and assist you in its preparation.

These relationships are very different than employment relationships. This review list is provided to inform you about this document in question and assist you in its preparation. You are wise to get this agreement signed with independent contractors to protect your interests in any irs audit.

The independent contractor non disclosure agreement is intended for use with workers sometimes known as 1099 contractors because of their tax status who perform tasks for you or your business. Agreement for independent irs form 1099 contracting services review list. W 2 employee or 1099 independent contractor.

Agreement for independent irs form 1099 contracting services review list.

Independent Contractor Agreement California Brilliant

Independent Contractor Agreement California Brilliant

Independent Contractor Agreement Free Download Docsketch

Independent Contractor Agreement Free Download Docsketch

Free One 1 Page Independent Contractor Agreement Form Pdf

Free One 1 Page Independent Contractor Agreement Form Pdf

Independent Contractor Agreement Template Contract The

Independent Contractor Agreement Template Contract The

Free Printable Independent Contractor Agreement Form

Free Printable Independent Contractor Agreement Form

Sample Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement

Independent Contractor Agreement

Free Virginia Independent Contractor Agreement Pdf Word

Free Virginia Independent Contractor Agreement Pdf Word

Independent Contractor Consultant Agreement Template Bonsai

Independent Contractor Consultant Agreement Template Bonsai

Belum ada Komentar untuk "10 1099 Contractor Agreement Template"

Posting Komentar