9 Charitable Donation Receipt Template

Donation receipt templates are essential to begin a charity. Charitable donation receipts are imperative documents especially for charity institutions because donations are non deductible for the donors.

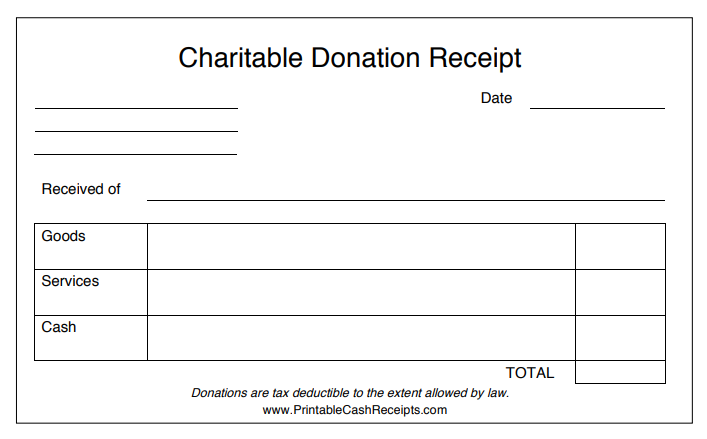

20 Free Donation Receipt Templates Amp Samples Free Fillable

20 Free Donation Receipt Templates Amp Samples Free Fillable

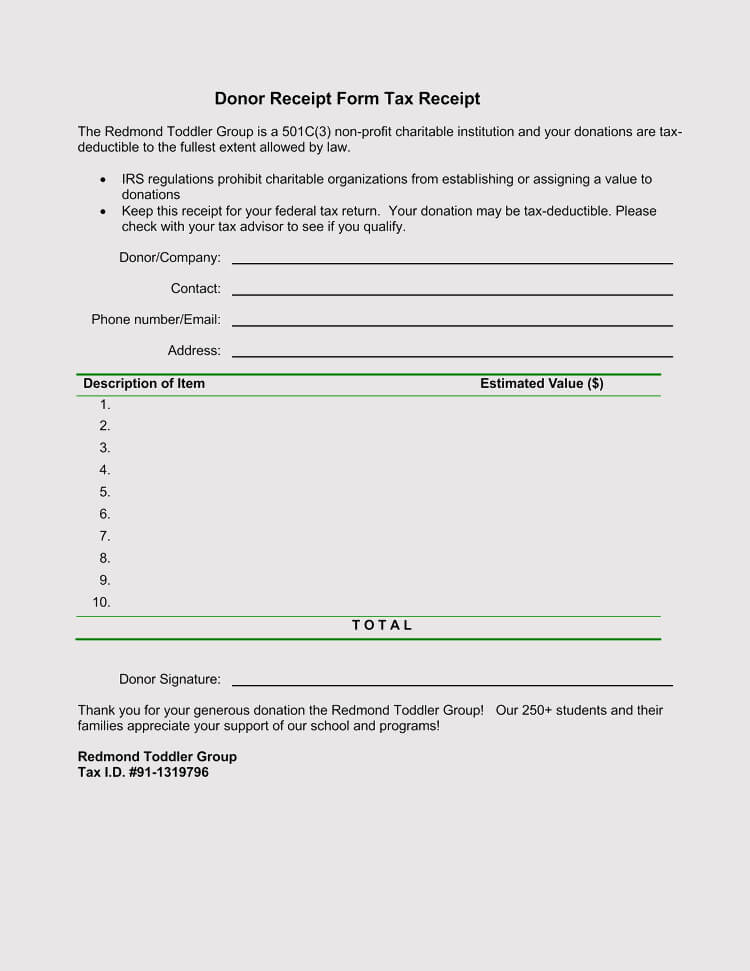

It must contain relevant details such as the name of the organization donor amount of donation received and the signature of the donor.

Charitable donation receipt template. The letter should state exactly what you received the worth of the item or the total amount when you received the donation and where you received it. These are customized templates that can be used multiple times. The date the donation was made.

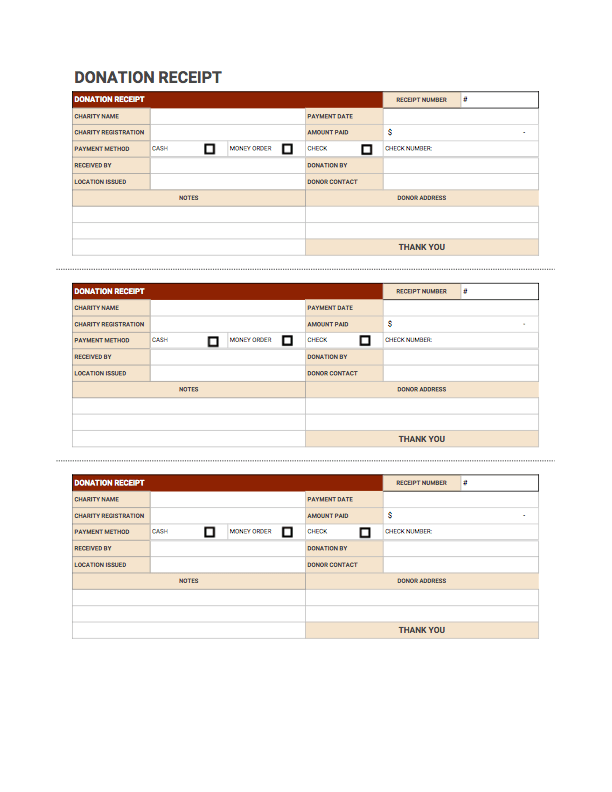

A donation receipt is an official document issued by an ngo or a charitable trust which can be provided to a particular person or an organization who has made the donation. We can help you with the creation of a donation receipt template so you can easily send a receipt to all of your donors. The 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more.

In order to be able to make your own donation receipt template youd have to know what exactly should be included in it. The first paragraph should mention the notice of receipt addressed to the donor. When you design your own receipt based on our templates you should include the following information in the receipt.

Include a notice of receipt. Information about the organization including logo name address tax identification number and a statement showing that the organization is a registered 501c3 organization. The name of the group organization or association along with its federal tin and a short notice which states that the group organization or association is registered.

You can make donation scripts digitally or use receipt templates available online which are printable too. A donation receipt acts as a written record that a donor is given proving that a. The donation receipt templates are fully customizable.

One requirement is that you give donors a donation receipt also known as a 501c3. This will help you keep a track of the number of donations made. An ideal donation script should include definite information about the amount of donation and what the donor received in return.

Get started creating the perfect template for your charity with our online receipt maker today. When accepting donations there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. This helps them keep track of their donations and enables you to see how much each person contributed to your charity.

Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual business or organizationprimarily the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal irs income tax. A donation receipt template is suitable for making your donations easier.

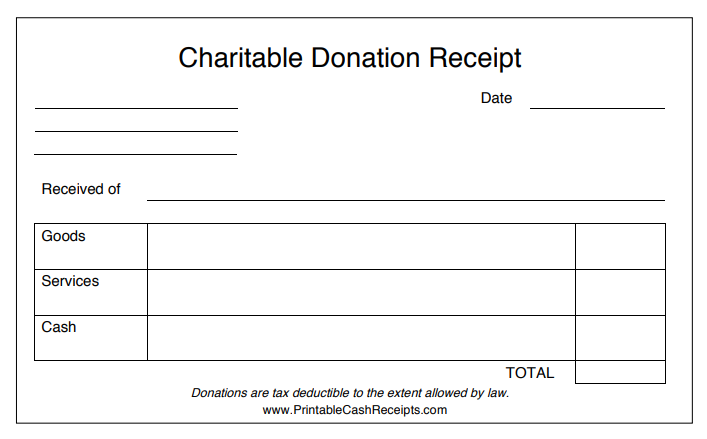

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

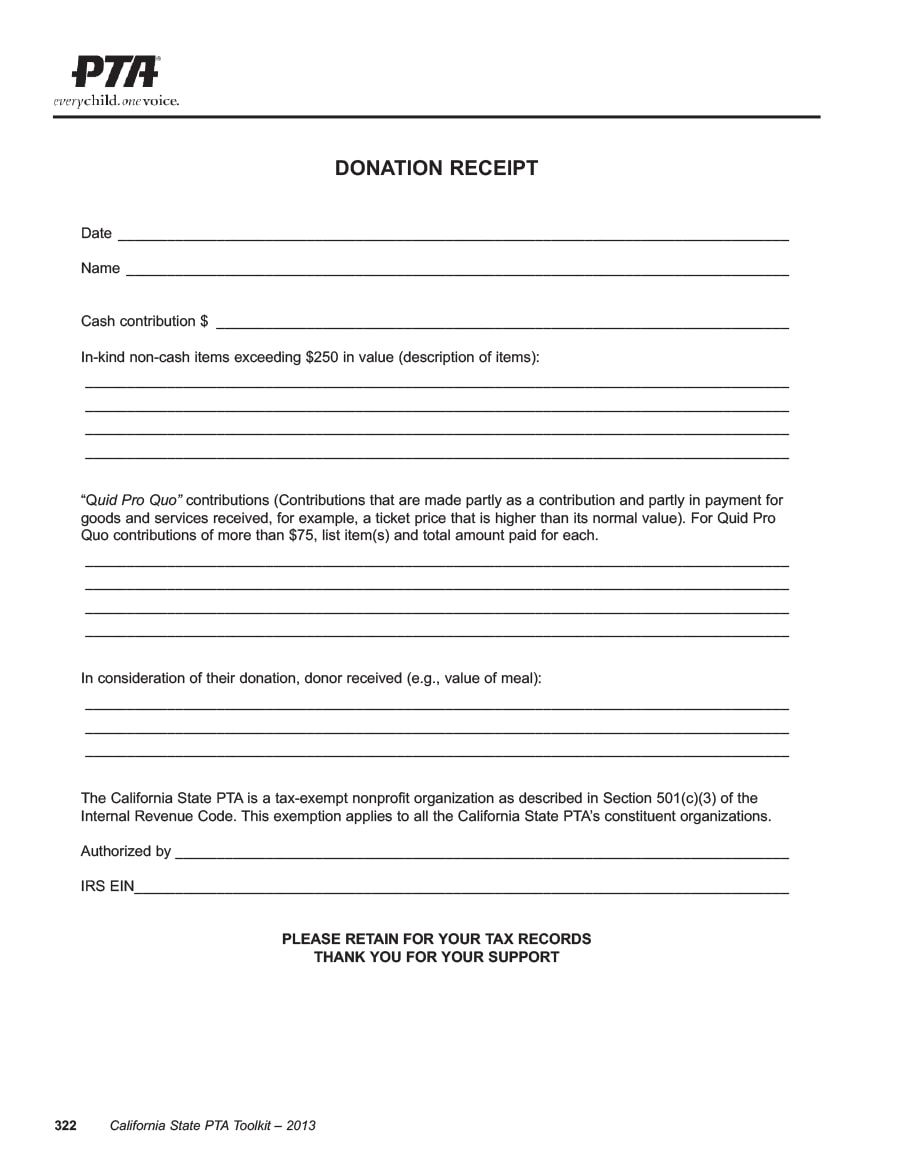

30 Non Profit Donation Receipt Templates Pdf Word

30 Non Profit Donation Receipt Templates Pdf Word

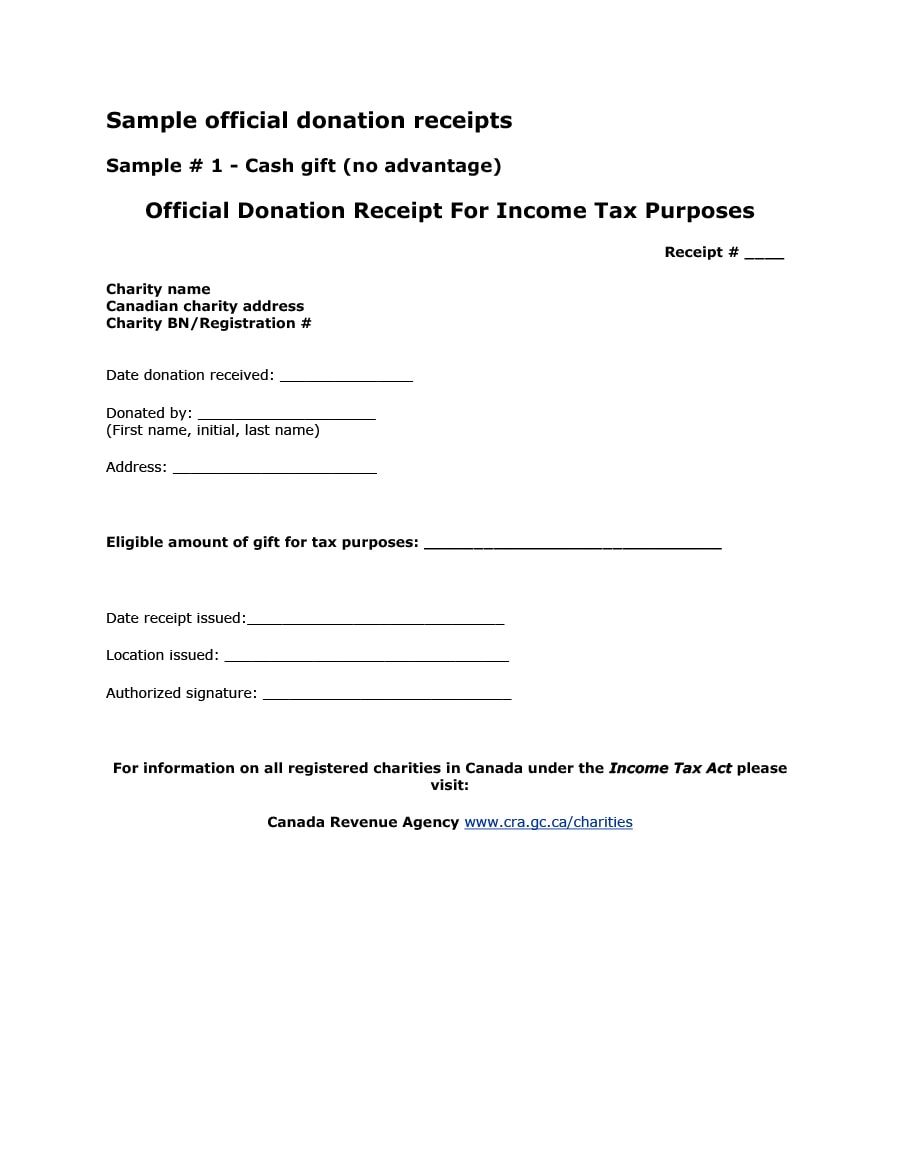

Sample Official Donation Receipts Canada Ca

Sample Official Donation Receipts Canada Ca

45 Free Donation Receipt Templates Non Profit Word Pdf

45 Free Donation Receipt Templates Non Profit Word Pdf

Donation Receipt Free Downloadable Templates Invoice Simple

Donation Receipt Free Downloadable Templates Invoice Simple

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

Donation Form Template Formsite

Donation Form Template Formsite

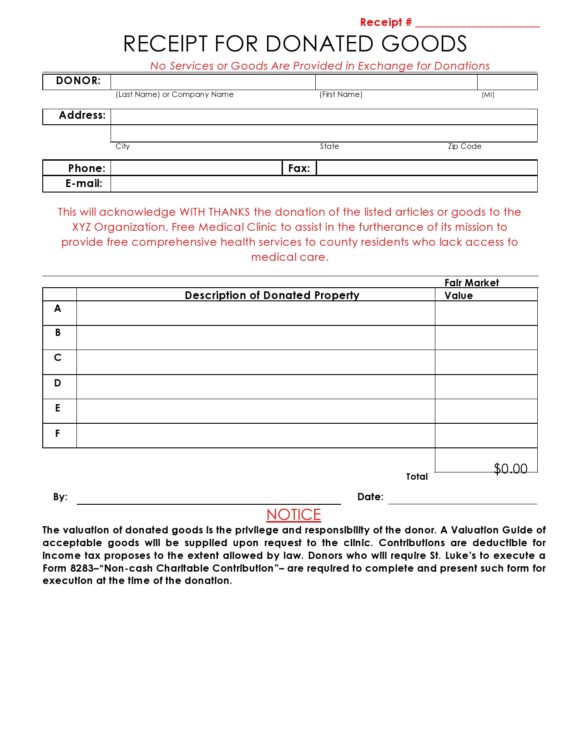

Donation Receipt Templates 38 Free Templates In Ms Word And

Donation Receipt Templates 38 Free Templates In Ms Word And

Belum ada Komentar untuk "9 Charitable Donation Receipt Template"

Posting Komentar