9 Commercial Due Diligence Checklist

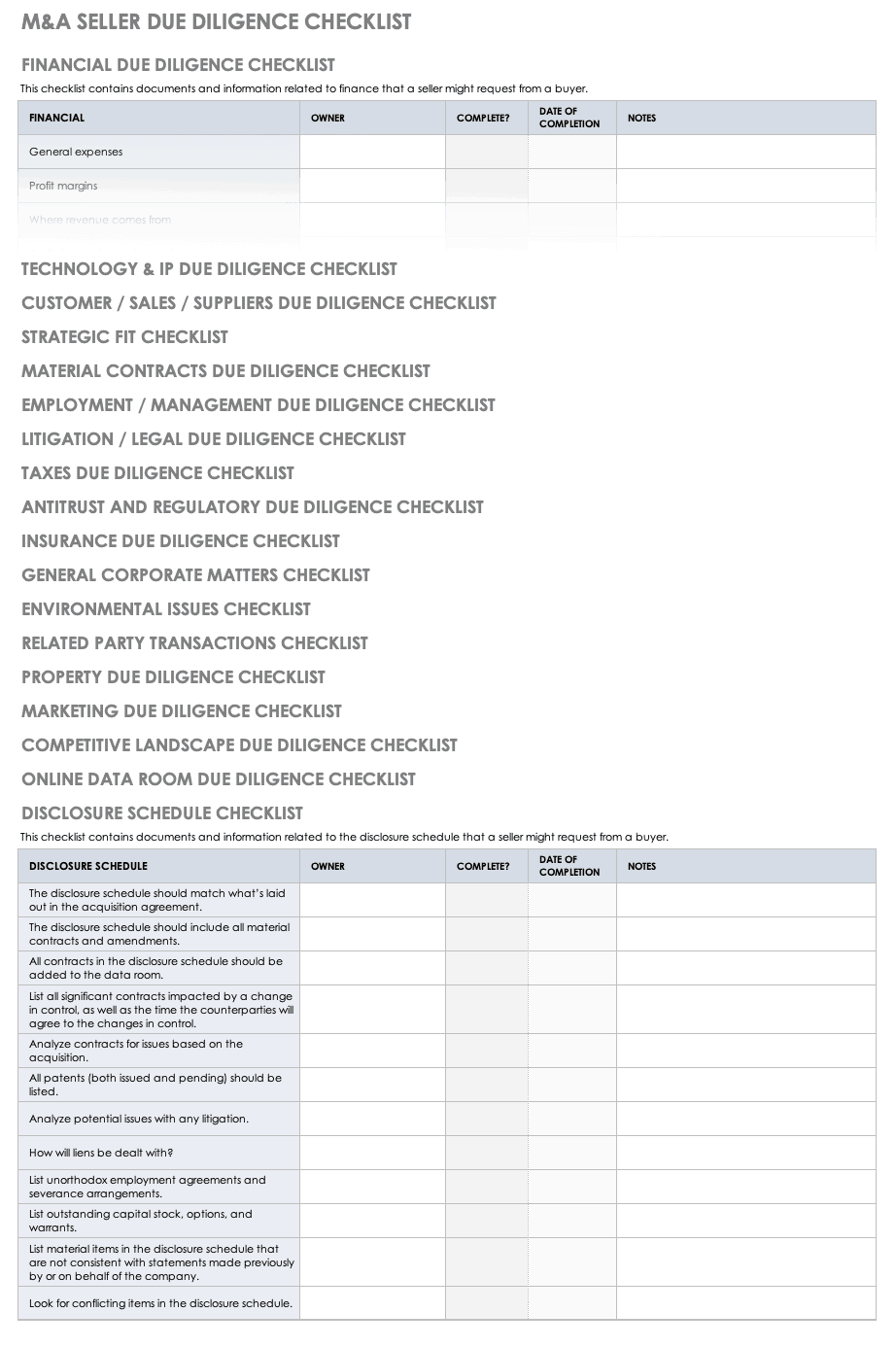

Legal due diligence the propertys title survey any 3rdparty reports zoning code compliance warranties etc. Due diligence documents or due diligence forms are records reports or other documents that helps verify and corroborate the due diligence process.

A Guide To Commercial Due Diligence Duedil

A Guide To Commercial Due Diligence Duedil

The commercial due diligence checklist entails an examination of competitors business area.

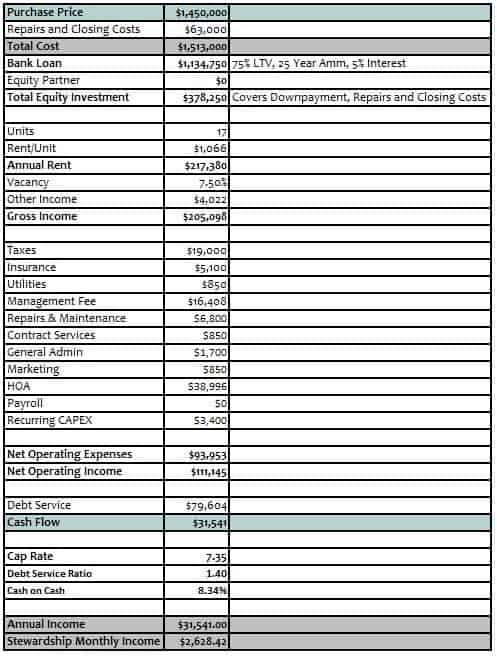

Commercial due diligence checklist. Annual and quarterly financial information for the past three years 1. How to use the checklist. A commercial due diligence report will vary depending on the nature of the target company however the contents of the report will remain largely the same across most industries.

Commercial diligence gives an assessment on the market and the target companys potential. Copyright peter harris commercial property advisors inc 2015. Planned versus actual results 3.

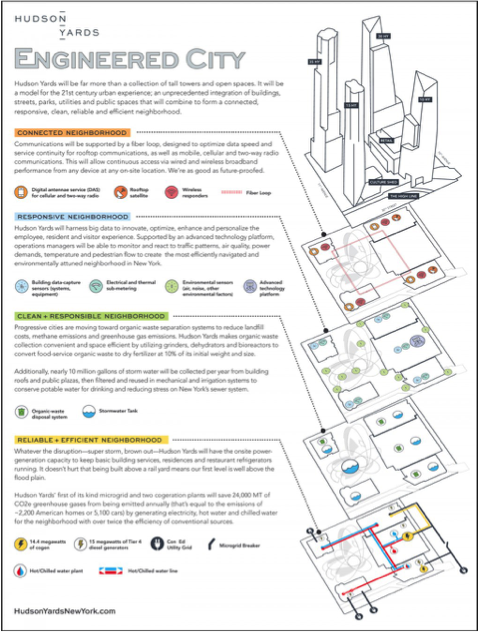

All subsequent analyses will reference the trade area geography as the basis for measurement and som share of market calculations. This report often includes top customers competitors and commercial policies. Due diligence is a comprehensive complex and critical stage in any commercial real estate acquisition.

Will be thoroughly examined. What are due diligence documents. Here you assess competitor market power and gauge the level competition is in the market.

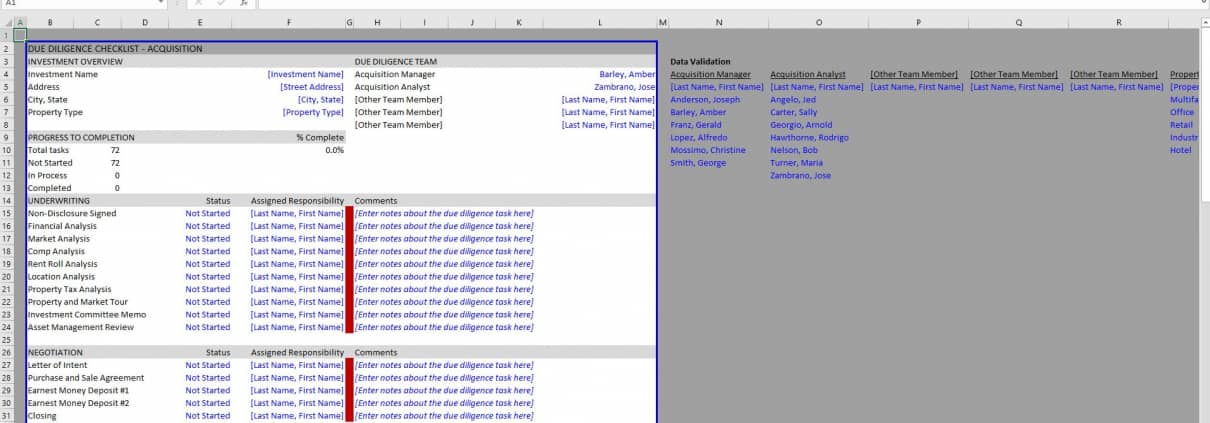

Although there are many elements of the due diligence process including obtaining new third party inspection reports and a title report the attached due diligence checklist focuses on information that buyers attempt to obtain from sellers. Under each category check off and verify each line item as it pertains to your deal. By following this checklist you can learn about a companys assets liabilities contracts benefits and potential problems.

Typically the report will include the following information. A thorough understanding of unit level trade area size is the foundation of a comprehensive commercial due diligence analysis. Due diligence is a key part of acquiring commercial real estate.

Income statements balance sheets cash flows and footnotes 2. A commercial due diligence checklist involves activities such as conversing with customers assessment of competitors and an analysis of the business plan. Commercial due diligence checklist this part of due diligence enables the potential acquirer to better understand a companys commercial soundness and appeal.

You dont want to leave any stone uncovered and you want the most time available to review all documents and look for any and all possible red flags with the property title tenant relationships and numerous other considerations. Management financial reports 4. Commercial due diligence checklist.

Review of the targets business plan and predictions. Due diligence checklists are usually arranged in a basic format. This will help you to determine how profitable the business can be and its potential profitable lifespan.

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale merger or another method. Sample due diligence checklist i. Breakdown of sales and gross profits by.

Real Estate Acquisition Due Diligence Checklist Adventures

Real Estate Acquisition Due Diligence Checklist Adventures

You Have Checked All The Boxes On Your Due Diligence

You Have Checked All The Boxes On Your Due Diligence

Due Diligence The Ultimate Guide For Real Estate Investors

Due Diligence The Ultimate Guide For Real Estate Investors

Free Due Diligence Templates And Checklists Smartsheet

Free Due Diligence Templates And Checklists Smartsheet

Due Diligence Checklist For Commercial Real Estate Acquisitions

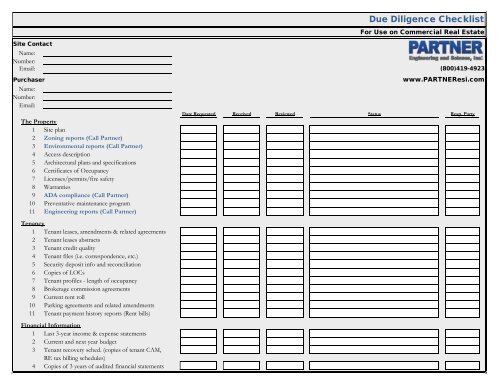

Commercial Real Estate Due Diligence Checklist Partner

Commercial Real Estate Due Diligence Checklist Partner

Belum ada Komentar untuk "9 Commercial Due Diligence Checklist"

Posting Komentar