10 Donation Tax Receipt Template

If the irs qualifies the organization receiving the donation as having tax exempt status the donation receipt is then used to claim a deduction on the donors income tax return. When donations are tax deductible the donation receipts issued by approved ipcs will indicate the words tax deductible.

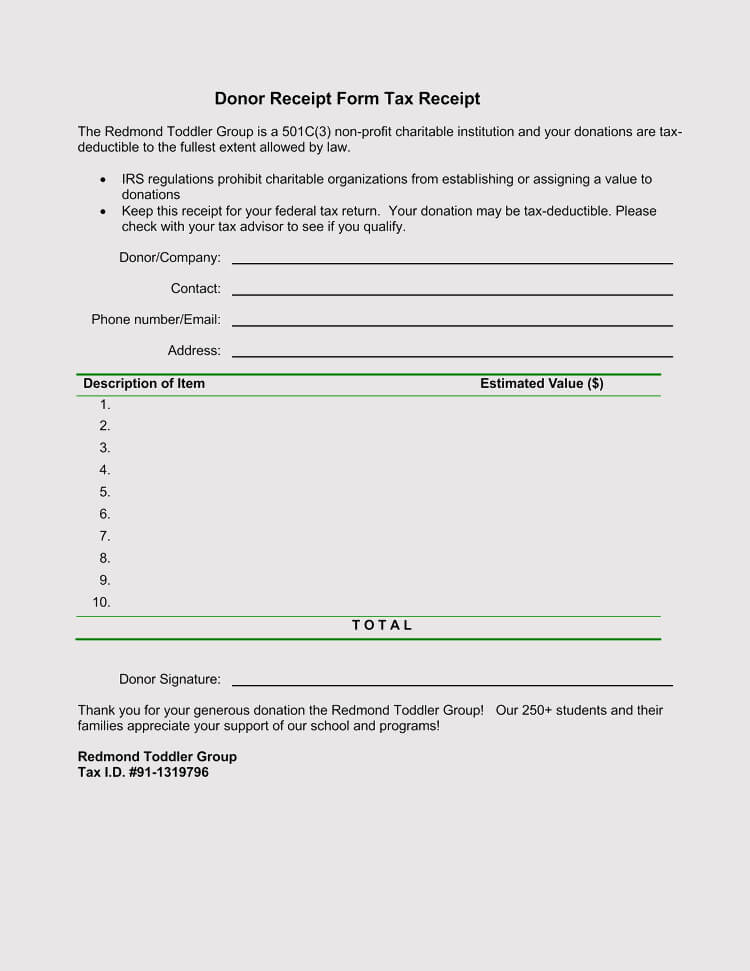

An acknowledgment by the charity is also essential to label it as a valid donation.

Donation tax receipt template. This is essential for the donor to deduct tax based on the donation made to an organization. A charitable tax receipt is used when giving out charitable donations. This could be in the form of a signature.

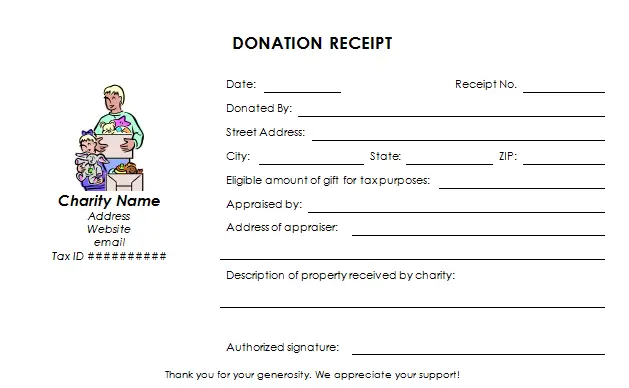

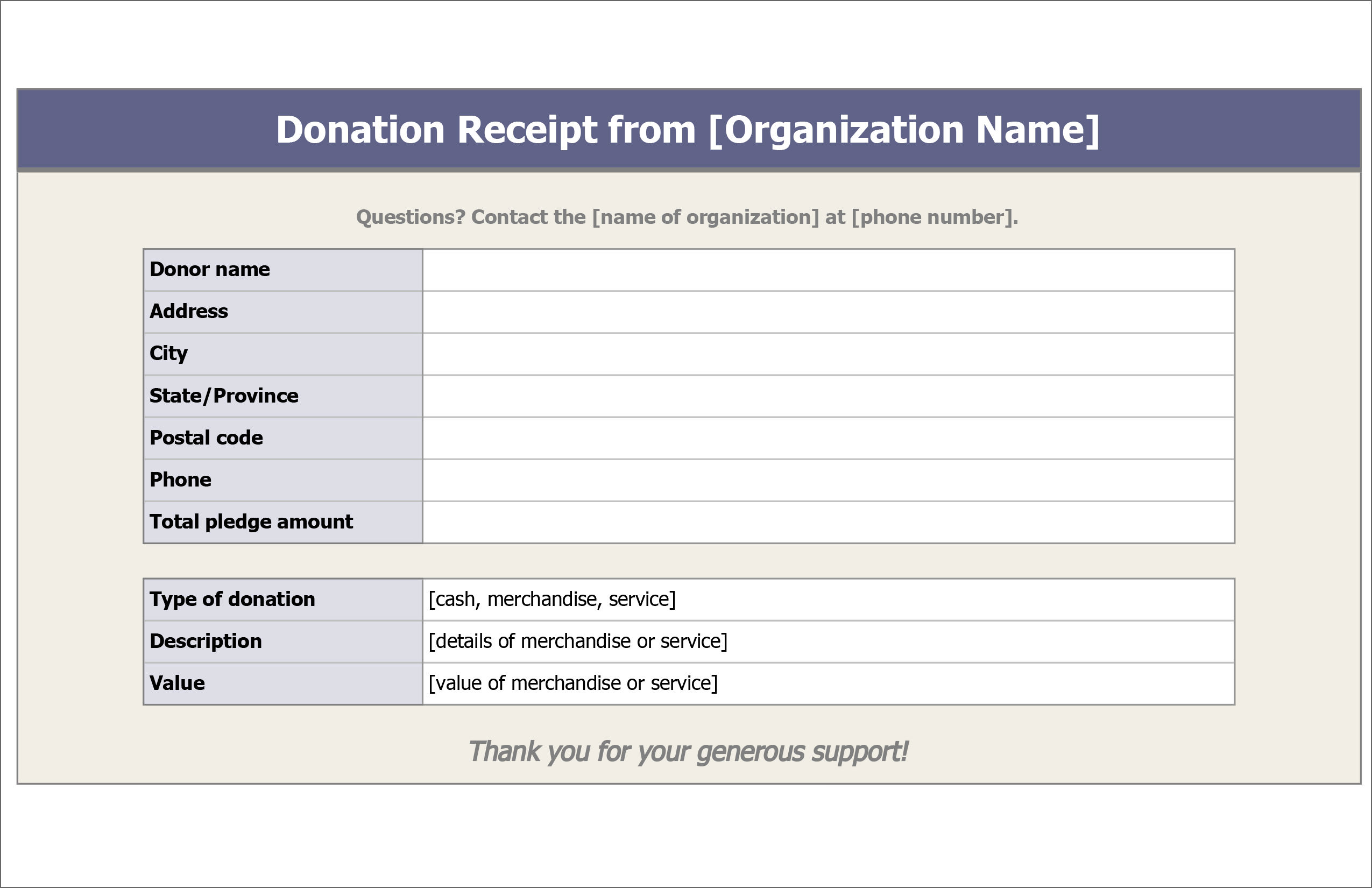

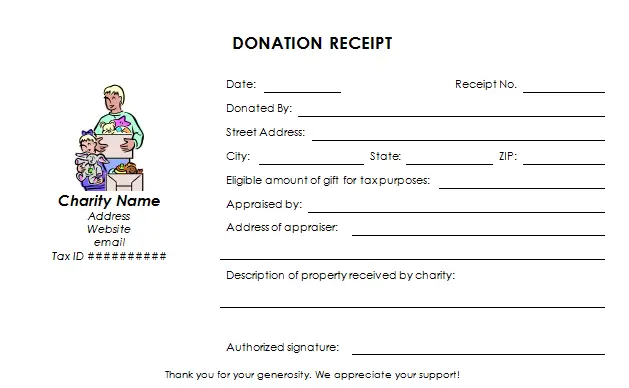

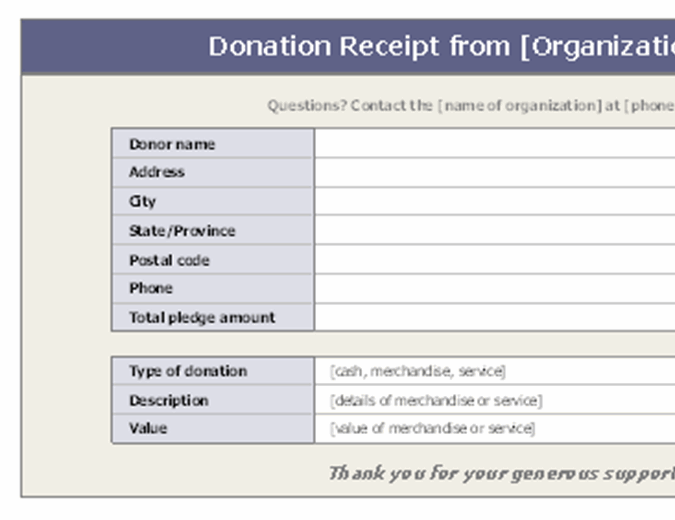

The deduction in taxes is not dependent on the amount of donation made. We provide you with a tax deductible donation receipt template to help you create tax deductible donation receipts quickly and easily. When writing this specific type of receipt you need to pay close attention to essential information such as the date of donation the amount donated in cash description of goods donated receivers name and address and signature.

Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. If you are managing a charity organization you must deal with creating tax deductible donation receipts on a regular basis. From 1 jan 2011 all individuals and businesses are required to provide their identification number eg.

These receipts are also used for tax purposes by the organization. This can also be produced as a letter. Wealthy people make donations to help out non profit and welfare organizations.

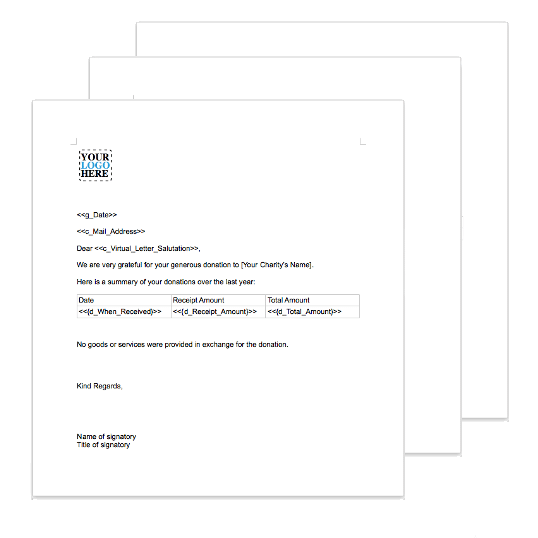

Nricfinuen when making donations to the ipcs in order to be given tax deductions on the donations. The receipt template is a microsoft word document so that you can customize it and make it work for your organization. Download these 12 free sample donation contribution receipt templates to create your own receipt.

A donation receipt acts as a written record that a donor is given proving that a gift has been made to a legal organization. All donors who are looking for a solid charity to donate to should choose their charity with caution if youre looking for a deduction as you want to get the best return for your dollar as possible. Often a receipt detailing the extent of all.

Sample donation receipt template. Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. However we are sure that an example of the same will help you create one with ease.

The 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. Also have a look at our editable receipt sample templates to make such documents easily. Donations not only help these social organizations but also help donors to get a subsidy in tax.

Printable donation receipt letter. If it is your first time creating a tax donation receipt letter we can understand your apprehensions well. A donation receipt template is customized as an email.

50 Free Donation Receipt Templates Word Pdf

50 Free Donation Receipt Templates Word Pdf

16 Free Receipt Templates Download For Microsoft Word

16 Free Receipt Templates Download For Microsoft Word

Tax Deductible Donation Receipt

Tax Deductible Donation Receipt

45 Free Donation Receipt Templates Non Profit Word Pdf

45 Free Donation Receipt Templates Non Profit Word Pdf

Charitable Donation Receipt Template

Charitable Donation Receipt Template

Donation Receipt Template Free

Sumac Nonprofit Donation Receipts

Sumac Nonprofit Donation Receipts

Configure Receipts For Donors Tax Deductible Donations

Configure Receipts For Donors Tax Deductible Donations

Sample Official Donation Receipts Canada Ca

Sample Official Donation Receipts Canada Ca

Belum ada Komentar untuk "10 Donation Tax Receipt Template"

Posting Komentar