8 How To Plan A Budget

If your expenses are more than your income that means you are overspending and need to make some changes. By keeping the lists separate you can make cuts more easily if you need to.

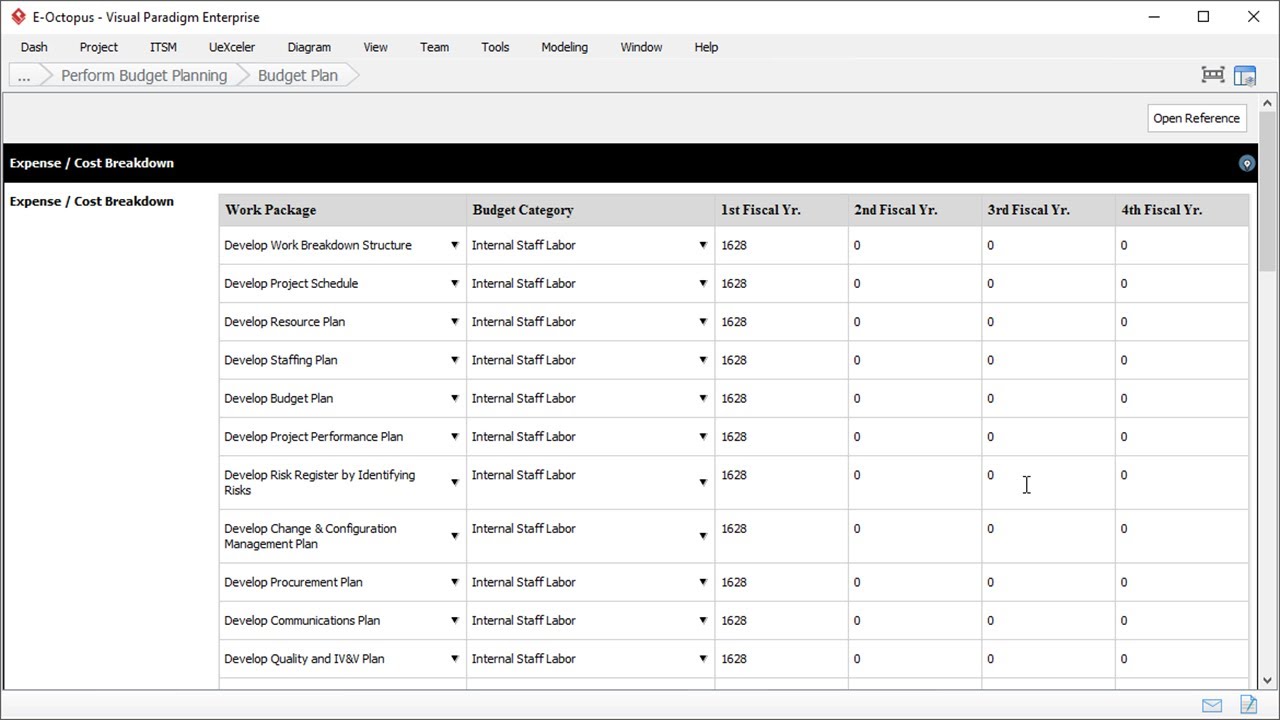

Budget Plan Template Project Management

Budget Plan Template Project Management

How to set up your budget.

How to plan a budget. See track your spending for practical ways to do this. Note your net income the first step in creating a budget is to identify the amount of money you have coming in. If you still have money left over great.

Having a clear picture of your regular expenses and spending habits will help you set up your budget. Use how often you get paid as the timeframe for your budget. Add up your budget essentials list and the extras list separately.

To do this track your spending over a week a fortnight or a month. Keep in mind however that its easy to overestimate what you can afford if you think of your total salary as what you have to spend. In a 50 30 20 budget needs or essential expenses should represent half of your budget wants should make up another 30 and savings and debt repayment should make up the final 20 of your budget.

Subtract the essentials total from your monthly income and if you have money left over subtract the extras total from that amount.

Budgeting 101 How To Start Budgeting For The First Time

Budgeting 101 How To Start Budgeting For The First Time

How To Stick To A Budget Money Management For Beginners

How To Stick To A Budget Money Management For Beginners

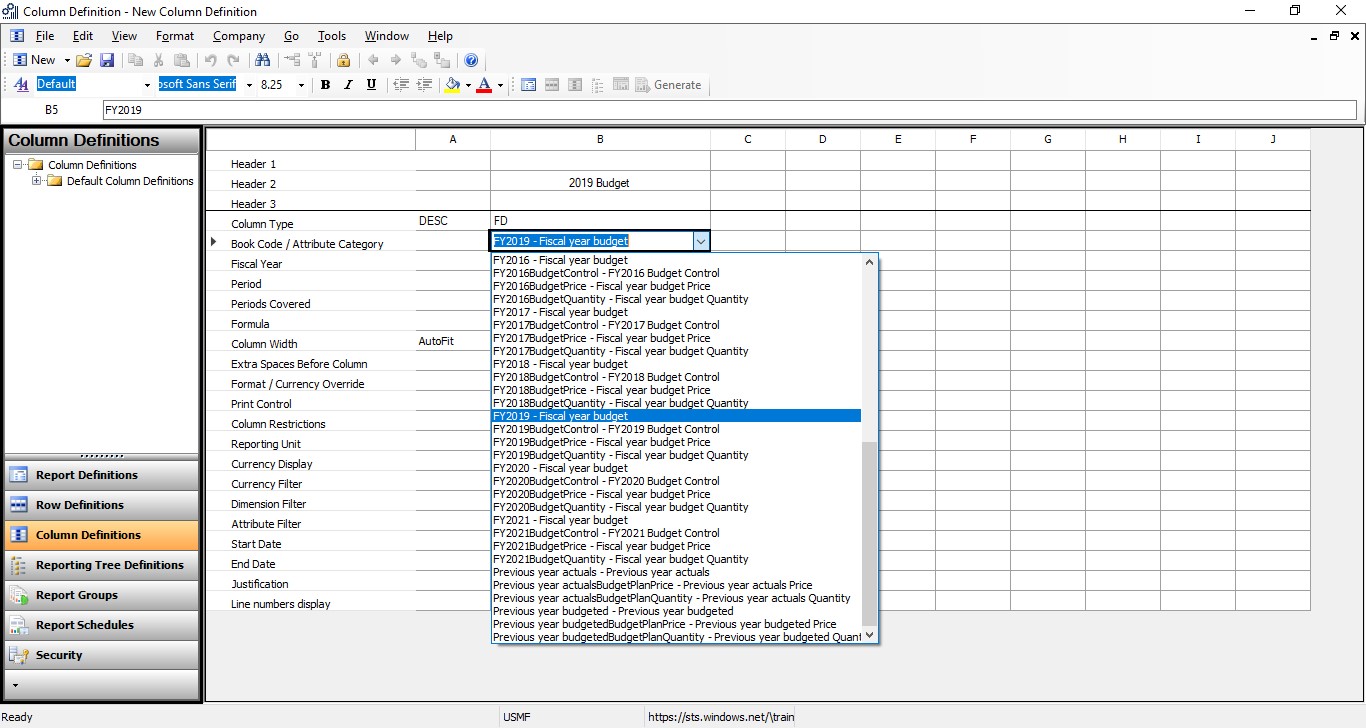

Playing Well With Others Budget Plans And Financial Report

Playing Well With Others Budget Plans And Financial Report

9 Smart Methods For Budget Meal Planning Cook Smarts

9 Smart Methods For Budget Meal Planning Cook Smarts

Review Budget Pacing Chart In A Budget Plan Search Ads 360 Help

Project Portfolio Management Understanding A Project Plan

Project Portfolio Management Understanding A Project Plan

What Is A Budget Daveramsey Com

What Is A Budget Daveramsey Com

Belum ada Komentar untuk "8 How To Plan A Budget"

Posting Komentar