8 How To Do A Budget Plan

Most people who make a budget do so because they want to accomplish more with their money. 6 steps for creating a budget plan step 1.

Your Hoa Budget Timeline And Tasks What Should You Do First

Your Hoa Budget Timeline And Tasks What Should You Do First

How often weekly fortnightly monthly or yearly this money could be from your wages pension government benefit or payment or income from investments.

How to do a budget plan. If you have a variable income for example from a seasonal or freelance job consider using the income from your lowest earning month in the past year as your baseline income when you set up your budget. Its often said in debtdo a budget skintdraw up a budget wife run off with the milkmanbudget yet while budgeting is seen as a solution unfortunately most budgets are worthless. To do this add together fixed costs like rent insurance and property taxes.

Based on your income essential expenses like utilities food and rent make up 50 of your spending. This is essential as knowing this information will help you create your entire budget plan. Take note of your income.

For more on how to create a project budget this article has all the info you need. Whichever method you choose personal budgeting involves three basic routines. Write down a list of all the expenses you expect to have during a month.

The first step to coming up with any kind of budget document is to know exactly how much income is coming in. If you receive a regular paycheck. The first step is to find out how much money you make each month.

Take a shortcut and make a plan to save at least 20 of your income. Then add variable costs like inventory purchases and semi variable costs like internet packages or employee salaries. The main problem is that because they concentrate on a typical month they massively underestimate your real spend as this misses huge costs such as christmas summer holidays new sofas or getting a new.

Here are some of the most popular ones. Create a list of monthly expenses. Track what you earn and what you spend.

Youll want to calculate your net income which is the amount of money you earn less taxes. To create a business budget start by forecasting your yearly expenditures. Granted if the budget you build in the proposal phase is carefully put together and everything goes according to plan you will end up using that directly as your project budget but for the purposes of this article lets just stick to the proposal phase.

The 503020 rule. If you dont have a regular amount of income work out an average amount. Make a list of all money coming in including.

Work to keep the second number lower than the first. This rule breaks down spending habits into 3 categories with certain percentages.

7 Free Marketing Budget Templates Marketing Com Au

7 Free Marketing Budget Templates Marketing Com Au

Lesson 2 Budg101 Budgeting 101

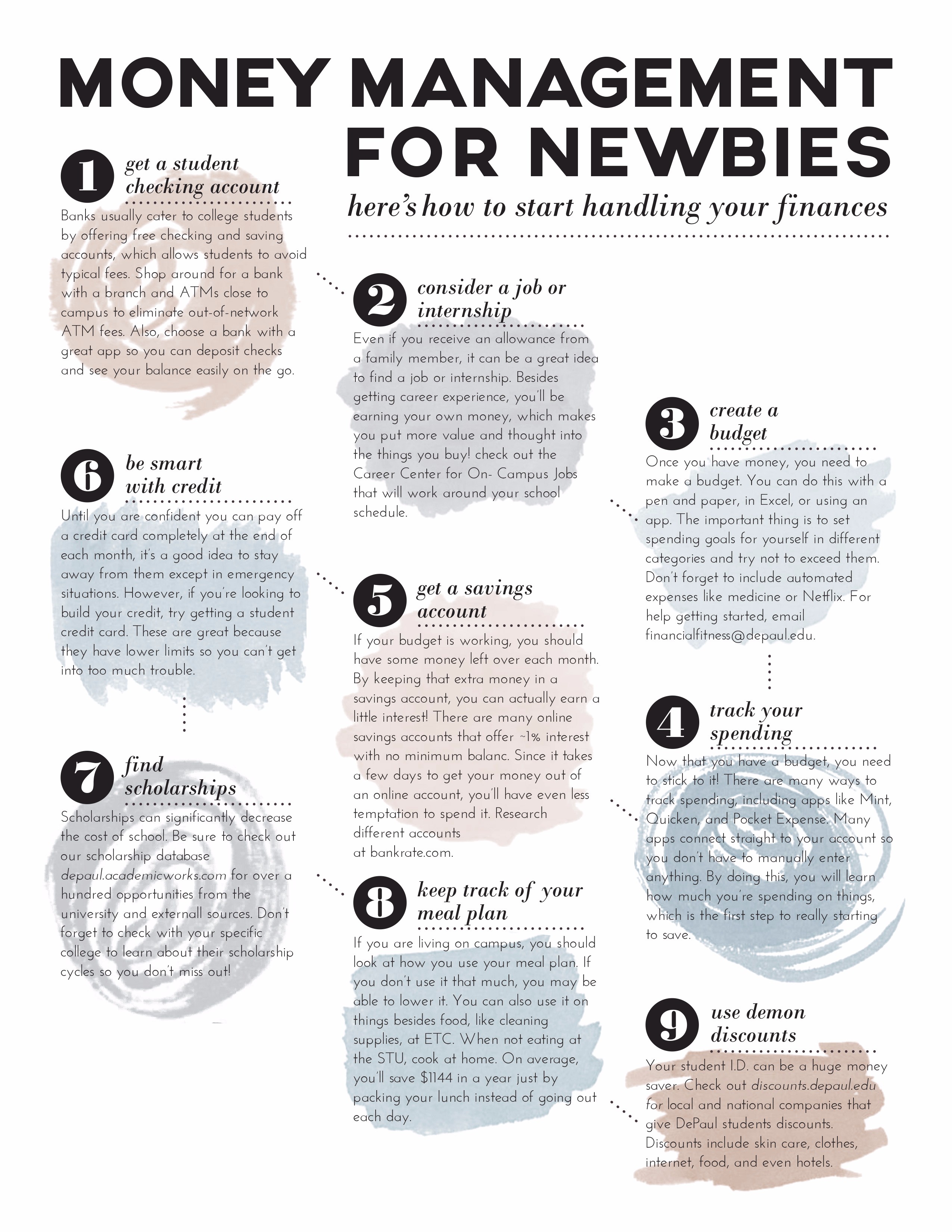

Creating A Money Plan Build A Budget Financial Fitness

Creating A Money Plan Build A Budget Financial Fitness

What Is Budgeting And Why Is It Important My Money Coach

What Is Budgeting And Why Is It Important My Money Coach

How To Make A Travel Budget Plan That Works A Complete Guide

How To Make A Travel Budget Plan That Works A Complete Guide

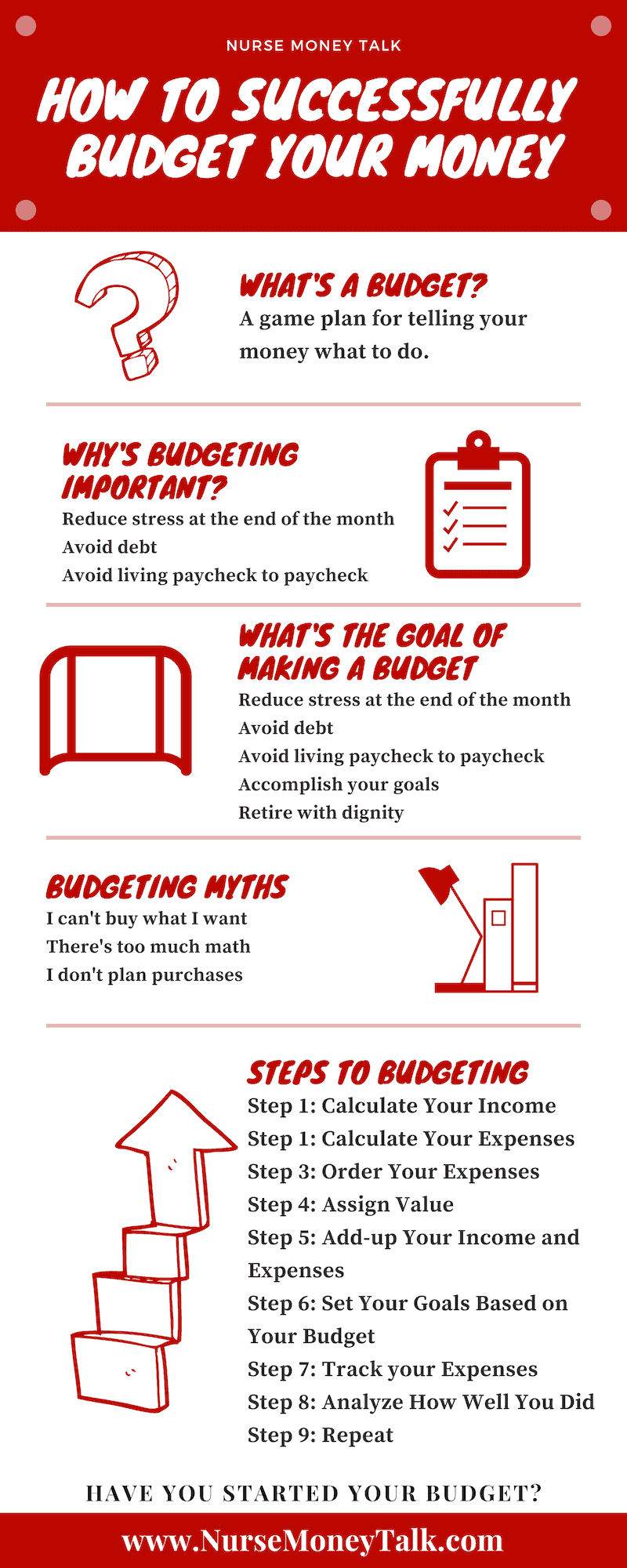

9 Step Budgeting Tips For Nurses Nurse Money Talk

9 Step Budgeting Tips For Nurses Nurse Money Talk

Budget Monitoring Action Planner Fmd Pro Starter

Budget Monitoring Action Planner Fmd Pro Starter

Belum ada Komentar untuk "8 How To Do A Budget Plan"

Posting Komentar