9 Mckinsey Dcf Valuation Model Xls

Dcf model discounted cash flow valuation model this simple dcf model in excel allows you to value a company via the discounted free cash flow dcf valuation method. And long term investing as well as fresh case studies.

Startup Valuation Vc Method Excel Spreadsheet

Startup Valuation Vc Method Excel Spreadsheet

It will give you identical answers in terms of value as the 2 stage ddm model.

Mckinsey dcf valuation model xls. Environmental social and governance issues. Measuring and managing the value of companies celebrating 30 years in print is now in its seventh edition john wiley sons june 2020. Discounted cash flow spreadsheet templatediscounted cash flow valuation methoddiscounted cash flow analysis templatediscounted cash flow calculator onlinediscounted cash flow analysis examplediscounted cash flow examplediscounted cash flow excel templatedcf template xlsmckinsey dcf valuation model xls.

Free discounted cash flow spreadsheet. Popular search terms 33 below are some of the most frequent used search terms on this site. This model uses a 2 stage fcff model to estimate the appropriate firm value multiples for your firm.

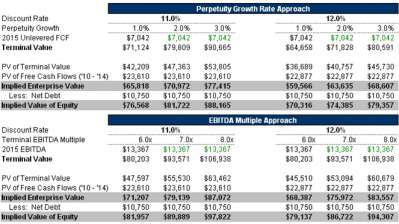

The discounted cash flow valuation model uses a three statement model to derive free cash flows to firm and discounts them to their present value. A complete fcff model that allows for changing. A model to value the premium you should pay for growth in either an intrinsic valuation or a relative valuation.

Valuation modeling in excel may refer to several different types of analysis including discounted cash flow dcf dcf model training free guide a dcf model is a specific type of financial model used to value a business. This is a model that uses a two stage dividend discount model to estimate the appropriate equity multiples for your firm. What is valuation modeling in excel.

A complete fcfe valuation model that allows you to capital rd and deal with options in the context of a valuation model. Mckinsey dcf valuation 2000 free download as excel spreadsheet xls pdf file pdf text file txt or view presentation slides online. Mckinsey dcf valuation model xls.

Carefully revised and updated this edition includes new insights on topics such as digital. See more ideas about cash flow excel excel templates. Excel modeling templates excel financial model templates download free financial model templates cfis spreadsheet library includes a 3 statement financial model template dcf model debt schedule depreciation schedule capital expenditures interest budgets expenses forecasting charts graphs timetables valuation comparable company analysis more excel templates.

Mckinsey dcf valuation model xls. Leveraged buyout valuation model ltm calculation ltm. The model is simply a forecast of a companys unlevered free cash flow analysis comparable trading multiples precedent transactions.

Amazon Com The Abcs Of Dcf Valuation Amp Modeling Simplified

Amazon Com The Abcs Of Dcf Valuation Amp Modeling Simplified

A Tutorial On The Discounted Cash Flow Model For Valuation Of

Valuation Part I Discounted Cash Flow Valuation Ppt Download

Valuation Part I Discounted Cash Flow Valuation Ppt Download

Financial Modeling Online Video Training Course For Bankers

Financial Modeling Online Video Training Course For Bankers

Analytical Solution To The Circularity Problem In The

Belum ada Komentar untuk "9 Mckinsey Dcf Valuation Model Xls"

Posting Komentar